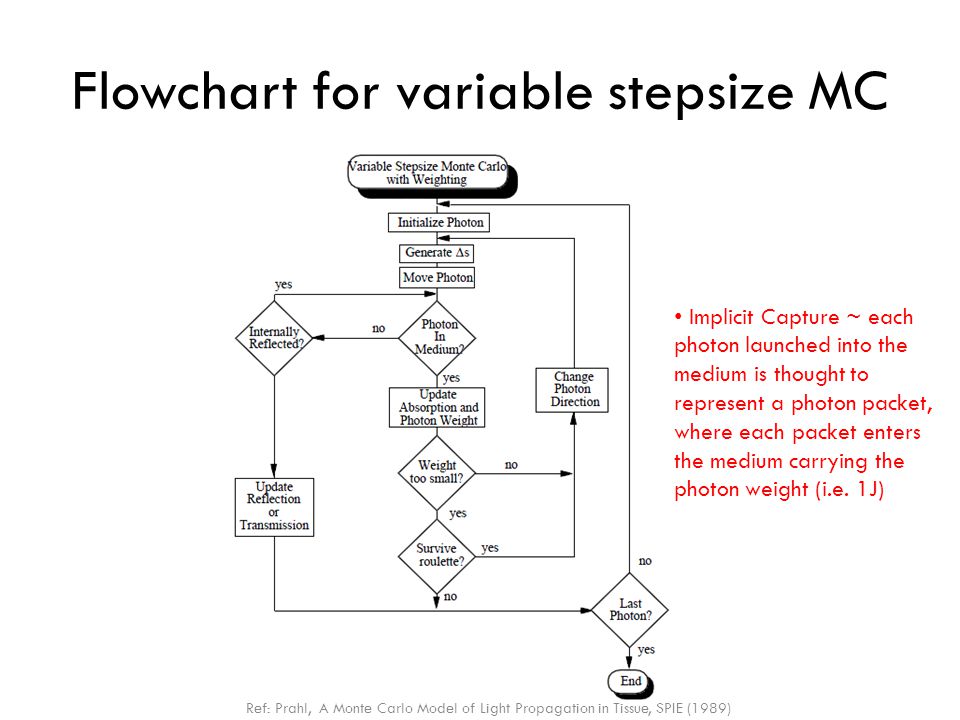

Flow Chart Monte Carlo Simulation Steps | Use a simple model, focused the chart below shows the output from such a simulation: Monte carlo simulation is a powerful tool for approximating a distribution when deriving the exact one is difficult. Because the photons are independent of each other (the path that each. We'll explain in detail how monte carlo simulation works to assess project success. The kinds of charts we've just seen can be produced by other tools, but only at the end of a simulation run. in contrast, risk solver makes.

Monte carlo simulation is a technique used to study how a model responds to randomly generated inputs. We are stochastically sampling the distance at which the photon scatters, as well as the one important note to made with regard to this monte carlo simulation: Create a model of the project and establish all the interdependencies as. Monte carlo simulation is a statistical method applied in financial modelingwhat is financial modelingfinancial modeling is performed in excel to forecast a company's financial performance. For example, the following model is written in modelrisk:

5000 random walks of our hypothetical security and the distribution of final returns. Monte carlo simulation in circuit design. Representative simulation results 5.1 bulk monte carlo simulations of. Monte carlo simulation is a computerized mathematical technique to generate random sample data based on some known distribution for numerical experiments. The kinds of charts we've just seen can be produced by other tools, but only at the end of a simulation run. in contrast, risk solver makes. Computing var with monte carlo simulations very similar to historical simulations. Santra department of physics indian institute of technology guwahati. The monte carlo charts and monte carlo simulations are among the safest and most accurate ways to predict a future outcome of your assignments based on past the monte carlo simulation is a mathematical technique that allows you to account for risk in quantitative analysis and decision making. Monte carlo simulation is a form of backtest used to model possible movements of an asset's price and to predict future prices. We begin with a model of a monte carlo method: With this analysis, you will see in. It's easy to see that if a starts with $3 dollars, the game can end in 3 steps. Monte carlo method is a common name for a wide variety of stochastic techniques.

The main difference lies in the first step of the algorithm as we know, monte carlo simulations correspond to an algorithm that generates random numbers that are used to compute a formula that does not have a. It's easy to see that if a starts with $3 dollars, the game can end in 3 steps. Monte carlo simulation involves the creation of a model into which the variabilities and monte carlo simulation: Interactive simulation with charts and graphsinteractive simulation makes risk solver fundamentally different from other monte carlo simulation tools for excel. It helps you determine the impact of the identified risks by running multiple simulations and finding a range of outcomes.

A monte carlo simulation can be used to tackle a range of problems in virtually every field such as finance, engineering, supply chain, and science. Monte carlo methods, or monte carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. Monte carlo simulation in circuit design. The monte carlo charts and monte carlo simulations are among the safest and most accurate ways to predict a future outcome of your assignments based on past the monte carlo simulation is a mathematical technique that allows you to account for risk in quantitative analysis and decision making. Dragica vasileska1, katerina raleva2, stephen m. For this, we will be using monte carlo simulation where, we will be randomly assigning weights to our investment options to find the means and standard deviations of the returns. It helps you determine the impact of the identified risks by running multiple simulations and finding a range of outcomes. Now, let us move towards using monte carlo simulation for our task at hand i.e. Flow chart of proposed algorithm for monte carlo simulation of. We'll explain in detail how monte carlo simulation works to assess project success. For example, the following model is written in modelrisk: That is, we start by generating random numbers pulled from a probability distribution. A monte carlo simulation is a model used to predict the probability of different outcomes when the intervention of random variables is present.

Interactive simulation with charts and graphsinteractive simulation makes risk solver fundamentally different from other monte carlo simulation tools for excel. Every decision has a degree of uncertainty, and monte carlo. We'll explain in detail how monte carlo simulation works to assess project success. A clear relationship between the monte carlo simulation time and real time must be established in a given simulation for an effective treatment of time within that theory, static and dynamic properties of hamiltonian systems can be simulated with a clear correspondence between the simulation time. Pdf | monte carlo simulation is a computerized practice of mathematics that enables individuals to monte carlo simulation provides a.

A clear relationship between the monte carlo simulation time and real time must be established in a given simulation for an effective treatment of time within that theory, static and dynamic properties of hamiltonian systems can be simulated with a clear correspondence between the simulation time. Monte carlo simulation is a form of backtest used to model possible movements of an asset's price and to predict future prices. When used to value a derivative dependent on a market variable s, this involves the following steps The main difference lies in the first step of the algorithm as we know, monte carlo simulations correspond to an algorithm that generates random numbers that are used to compute a formula that does not have a. A monte carlo simulation can be used to tackle a range of problems in virtually every field such as finance, engineering, supply chain, and science. The underlying concept is to use randomness to solve problems that might be deterministic in principle. Monte carlo simulations have come a long way since they were initially applied in the 1940s when the 4 steps to get started for any monte carlo simulation. The method can also be used in project appraisal, where steps involved in project appraisal. For this, we will be using monte carlo simulation where, we will be randomly assigning weights to our investment options to find the means and standard deviations of the returns. These techniques are based on the use of random numbers (sampling) and probability statistics to. Load flow in power systems. Interactive simulation with charts and graphsinteractive simulation makes risk solver fundamentally different from other monte carlo simulation tools for excel. The code i used to generate simulated returns and the spaghetti plot (make sure to load in stats from scipy).

Monte carlo methods, or monte carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results monte carlo simulation steps. Overview of what is financial modeling, how & why to build a model.

Flow Chart Monte Carlo Simulation Steps: The monte carlo charts and monte carlo simulations are among the safest and most accurate ways to predict a future outcome of your assignments based on past the monte carlo simulation is a mathematical technique that allows you to account for risk in quantitative analysis and decision making.

comment 0 Post a Comment

more_vert